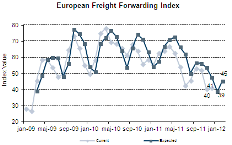

European air freight buyers are expressing a significant improvement in their expectations forvolumes in the coming months, according to Danske Bank’s Freight Forwarding Index.

Following volume declines in the second half of last year, expectations for the road and airfreight segment increased among European forwarders from an all-time low last month “and are nowindicating close to a no-growth scenario in the coming two months”, the organisation reported.

Expectations for air freight sank to a record low of 30 on the index in November, indicatingthat most respondents in November had expected the volumes of goods they handle to decline over thesubsequent two-month period, adjusted for normal seasonality in the business. On average,respondents reported that their air freight volume levels remained stable in November, but theexpectation index rose in December to 50, indicating that, on average, the number of respondentsexpecting volumes over the next two months to grow or decline are roughly equal.

A slight majority of European forwarders saw their road freight volumes decline in November,indicated by an index reading of 46, although the road freight expectations index rose last monthfrom 39 to 48, indicating that only a small majority of respondents now expect road freight volumesto decline in the next two months.

However, expectations in the sea freight segment deteriorated, with the majority of respondentsto the survey now anticipating lower volumes in the coming two months, despite flat volumes inNovember.

Overall, participants now expect only a slight decrease in volumes in the coming two-monthperiod, “which is more positive than in the previous month,” observed Kristian Godiksen, one of theDanske Bank analysts responsible for the survey. “We note that expectations for air freight havepicked up, which could be seen as a positive sign, as air freight is normally a leading indicatorfor other transportation segments.”

Forwarders in Eastern Europe, Finland and Norway are currently the most optimistic, where themajority expect volumes to increase or remain the same in the next two months, while Swedishforwarders, on average, expect neither growth nor decline. In contrast, Swiss forwarders are themost pessimistic, while a small majority of those in Germany, the UK, Denmark and the Beneluxcountries expect volumes to decline.

The International Air Transport Association (IATA) reported that air freight markets continuedtheir decline in November “in line with weak economic performance and falling business confidence”.International markets declined by 3.8%, partially offset by 2.0% growth in domestic markets.Nonetheless, system-wide demand shrank by 3.1% in comparison with November 2010.

Early last month, IATA downgraded its 2012 expectations for the air cargo market, which theairline association now expects to be flat during the year – revised downwards from the previousforecast of 4.2% expansion.